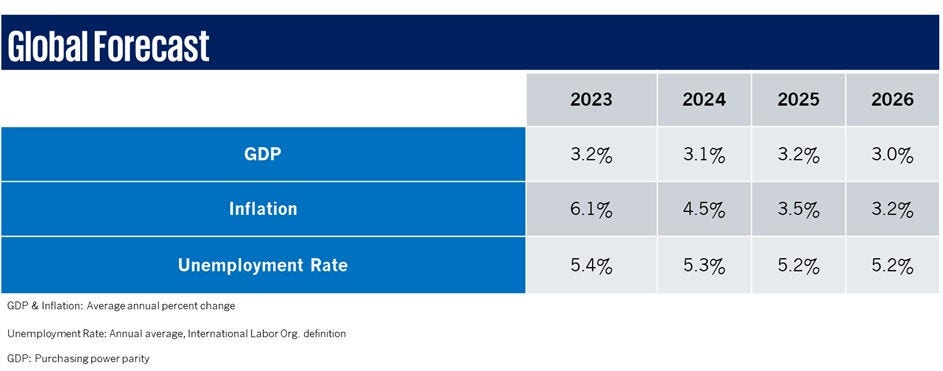

- KPMG International forecasts GDP growth picking up from 3.1% in 2024 to 3.2% in 2025

- Inflation forecast to cool from 4.5% in 2024 to 3.5% in 2025

- Geopolitical risks remain elevated with post-US election policies, including possible tariffs, potentially hitting growth and inflation in 2026

KPMG Global Economic Outlook – December 2024

KPMG International is forecasting global growth will rise slightly in 2025 to 3.2 percent before post-election policies in the US dampen global GDP to 3.0 percent in 2026.

The latest expectations in the December 2024 KPMG Global Economic Outlook highlight the continued geopolitical and economic uncertainty slowing down the impact of recent central bank efforts to return the world to a path of sustainable growth.

KPMG forecasts the pace of inflation will continue cooling between now and mid-2025. Thereafter, the forecast depends heavily on the pace of tariffs and whether we see a full-blown trade war erupt.

Geopolitical risk remains elevated. Following the outcome of the US election, inflationary trade and immigration policies are expected to slow the pace of credit easing. Bond yields have already moved up in response to fears of mounting federal debt and higher inflation. Any major shift in tariffs in the US could trigger retaliatory measures.

Global inflation has cooled in response to higher rates, slower growth, excess supply and a drop in energy prices. Service sector inflation is beginning to moderate as well. A lingering concern is outsized wage gains in Europe where productivity growth lags. There is a backlash forming towards foreign tourism, as it is further propping up service sector inflation.

Delays in the effects of monetary policy will push the influence of rate cuts into the second half of 2025 and 2026. We could see a tailwind for big-ticket consumer purchases and business investment. Much is contingent on headwinds due to retaliatory tariffs.

Fiscal policy may be more stimulative. COVID-era appropriations have lapsed, but market participants are betting on a new wave of stimulus. The biggest gains in spending are expected to be in pensions, healthcare and defense. Tax cuts are expected to be extended in full in the US; what is unknown is how multinationals not located in the US will be treated.